Introduction

In June 2024, Nvidia Corporation (NVDA), a leader in the semiconductor industry, announced a significant 10-for-1 stock split. This move aimed to make Nvidia’s shares more accessible to a broader range of investors. In this article, we delve into the details of this stock split, its historical context, and its impact on investors.

What is a Stock Split?

A stock split is a corporate action where a company issues additional shares to shareholders, increasing the total by the specified ratio based on the shares they held previously. For example, in a 10-for-1 split, shareholders receive ten shares for every one share they previously owned.

While the number of shares increases, the overall value of the investment remains unchanged, as the price per share adjusts accordingly. Companies typically implement stock splits to make their shares more affordable and attractive to investors.

Nvidia’s 10-for-1 Stock Split Details

Nvidia’s 10-for-1 stock split was executed as follows:

- Record Date: Shareholders holding Nvidia stock at the close of business on June 6, 2024, were eligible for the split.

- Distribution Date: On June 7, 2024, shareholders received nine additional shares for each share held.

- Trading Adjustment: Trading of Nvidia’s stock on a split-adjusted basis commenced on June 10, 2024.

For instance, if an investor owned 100 shares priced at $1,200 each before the split, they would receive 900 additional shares, bringing their total to 1,000 shares. Post-split, the share price would adjust to approximately $120, maintaining the overall investment value.

Historical Context of Nvidia’s Stock Splits

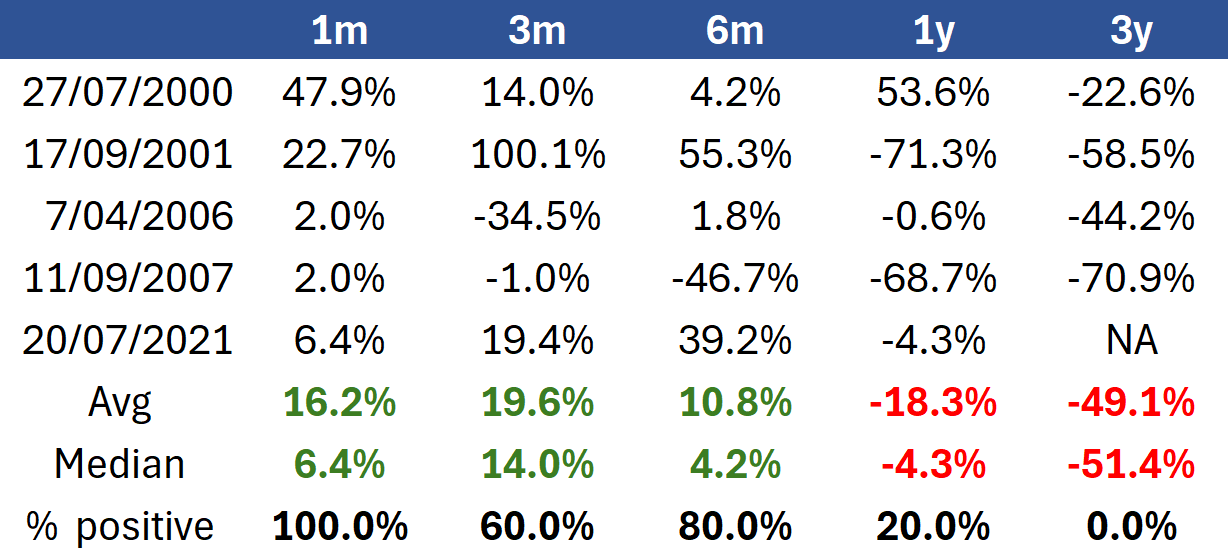

Since its initial public offering in 1999, Nvidia has undergone six stock splits:

- June 27, 2000: 2-for-1 split

- September 12, 2001: 2-for-1 split

- April 7, 2006: 2-for-1 split Passport to Wall Street+1Webull+1

- September 11, 2007: 3-for-2 split

- July 20, 2021: 4-for-1 split

- June 10, 2024: 10-for-1 split

The 10-for-1 split in 2024 marked the largest in Nvidia’s history, reflecting the company’s substantial growth and high share price.

Latest Business Trends in FtasiaFinance from FintechAsia

Rationale Behind the Stock Split

Nvidia’s decision to implement a 10-for-1 stock split was driven by several factors:

- Enhanced Affordability: Reducing the share price post-split aimed to make Nvidia’s stock more accessible to individual investors, particularly those who found the pre-split price prohibitive.

- Increased Liquidity: A lower share price could lead to higher trading volumes, improving liquidity and making it easier for investors to buy and sell shares.

- Psychological Appeal: Stock splits often generate positive market sentiment, as investors perceive them as a sign of a company’s confidence and growth prospects.

Impact on Shareholders

For existing shareholders, the stock split had the following implications:

- Shareholding Adjustment: Shareholders saw an increase in the number of shares they owned, with the total value of their holdings remaining unchanged immediately after the split.

- Price Adjustment: The market price per share adjusted downward proportionally to the split ratio. For example, if the share price was $1,200 before a 10-for-1 split, it would adjust to approximately $120 post-split.

- Dividend Considerations: Future dividends were expected to be paid on a per-share basis. Therefore, while the dividend per share might be lower due to the increased number of shares, the total dividend income for shareholders holding the same value of stock would remain consistent.

Market Reaction and Performance Post-Split

Following the announcement and execution of the stock split, Nvidia’s stock experienced notable market reactions:

- Share Price Movement: After the split, Nvidia’s stock price remained relatively stable, reflecting the proportional adjustment in share price.

- Investor Sentiment: The split was viewed positively, as it made Nvidia’s shares more accessible to a broader investor base, potentially increasing demand and liquidity.

- Long-Term Performance: Historically, stock splits have had varying impacts on long-term stock performance. While they can lead to short-term positive sentiment, the long-term effects depend on the company’s continued performance and market conditions.

Nvidia (NVDA) Stock Soars: Nvidia’s Market Cap Hits $3.4 Trillion, What’s Next?

Considerations for Potential Investors

For investors considering purchasing Nvidia stock post-split, it’s essential to:

- Evaluate Company Fundamentals: Focus on Nvidia’s financial health, market position, and growth prospects rather than the stock split itself.

- Understand Investment Goals: Align investment decisions with personal financial goals and risk tolerance.

- Stay Informed: Keep abreast of Nvidia’s product developments, market trends, and industry news to make informed investment choices.

Conclusion

Nvidia’s 10-for-1 stock split in June 2024 was a strategic move to enhance share affordability and liquidity, reflecting the company’s growth and commitment to its shareholders. While the split adjusted the share price and number of shares, the overall value of shareholders’ investments remained unchanged immediately after the split. Investors should focus on Nvidia’s fundamental business performance and long-term growth prospects when making investment decisions.

FAQs

- What was the reason for Nvidia’s 10-for-1 stock split? Nvidia implemented the 10-for-1 stock split to make its shares more affordable and accessible to a broader.